Avalanche (AVAX)

Avalanche is a blockchain platform that aims to solve the trilemma of blockchain scalability, security and decentralization through its unique proof-of-stake (PoS) mechanism.

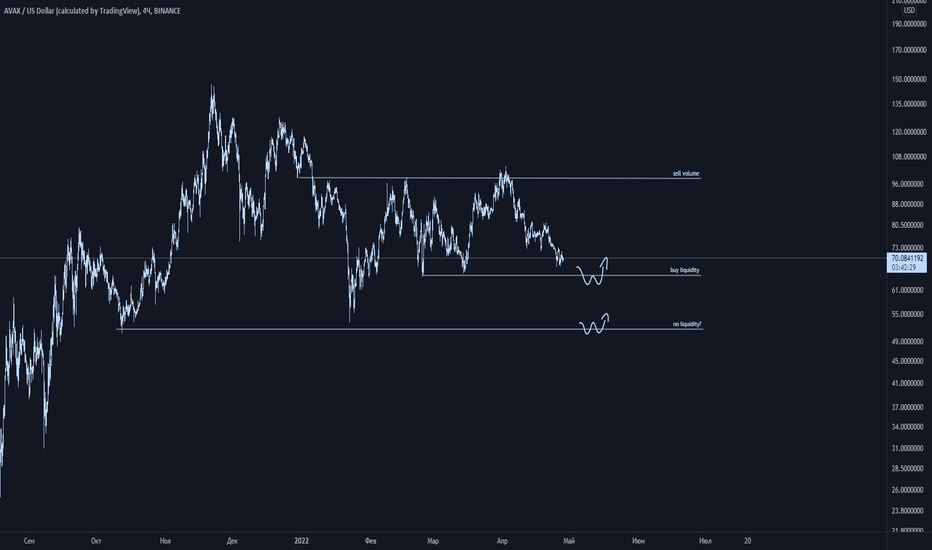

Visit the Avalanche pricing page for more information on the current cost, trends and price history of AVAX.

Like Ethereum, Avalanche supports smart contracts for running decentralized applications (dApps) on its network. Since Avalanche’s smart contracts are written in the Solidity language, which is also used in Ethereum, the company aims to create a larger, interoperable blockchain by integrating a number of decentralized finance (DeFi) ecosystems, including well-established projects such as Aave and Curve. .

AVAX, the native token of the Avalanche platform, is used to enable transactions within its ecosystem. AVAX serves as a means of distributing system rewards, participating in governance, and facilitating transactions on the network through the payment of fees.

How does an avalanche work?

Although the Avalanche platform is complex, there are three main aspects of its design that set it apart from other blockchain projects: the consensus mechanism, the inclusion of subnets, and the use of multiple integrated blockchains.

Avalanche Consensus:

In order for a blockchain network to verify transactions and remain secure, it must use a protocol that allows its nodes to reach an agreement or consensus. In terms of cryptocurrencies, the conversation focused on proof of work (PoW) and proof of stake (PoS) as the main methods of achieving this agreement.

Avalanche uses a new consensus mechanism based on PoS. When a user initiates a transaction, it is received by a validator node, which selects a small random set of other validators to see if they agree. Validators perform this sampling procedure repeatedly, “gossiping” among themselves, to finally reach a consensus.

Thus, one validator’s message is sent to other validators, who select even more validators again and again until the entire system reaches agreement on the outcome. Just as one snowflake can turn into a snowball, a single transaction can turn into an avalanche over time.

Validator rewards increase based on the amount of time a node has staked its tokens (called “Proof of Work”) and whether the node has historically acted according to software rules, called “Proof of Correctness.”

Subnets:

Avalanche users can run custom chains that can operate using their own rulesets. This system can be compared to other blockchain scaling solutions such as Polkadot parachains and Ethereum 2.0 shards.

Consensus on these chains is achieved through subnets (or subnets), which are groups of nodes that participate in validating a designated set of blockchains. All subnet validators must also validate the Avalanche mainnet.

Embedded Blockchains:

Digital assets can move along each of these chains, serving different functions in the ecosystem. This includes Avalanche’s native token, AVAX.

The contract chain (C-Chain) allows you to create and execute smart contracts. Because Avalanche smart contracts are based on the Ethereum Virtual Machine, they can take advantage of cross-chain interactions.

Why use AVAX?

Avalanche offers a highly reliable, highly secure network that combines transaction speed and profitability while remaining easy to use and securely decentralized.

Why is AVAX valuable?

Like many other cryptocurrencies, Avalanche has a limited supply of 720 million AVAX tokens, half of which were created and distributed during Avalanche’s launch in 2020. The remaining tokens will be generated through the minting process in the form of staking rewards.

Since validator rewards are based on proofs of work and proofs of correctness, AVAX staking is highly incentivized, creating a system where the circulating supply of AVAX remains relatively low even when demand for the token is high.

Additionally, unlike other blockchains such as Bitcoin and Ethereum, Avalanche fees are not paid to network validators. Instead, all commissions are burned. This further increases the AVAX scarcity, which is offset by the minting process to ensure the longevity of the network.